‘Higher rebate ceiling means more players’

The Commonwealth Casino Commission determined that an increase in rebate for VIP players at the Saipan casino would increase revenues and tax collected, in approving a rebate increase earlier this month from 1.4 percent of amount rolled to 1.8 percent.

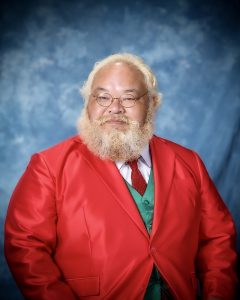

According to commission executive director Edward Deleon Guerrero, the rolling chip rebate program is considered a marketing cost, an expense that is deductible from tax obligation.

“The more you raise the rolling chip [rebate] the more you will offset your tax liability at the end of the year because it is subject to deductions,” Guerrero said.

“They’re [Best Sunshine International, Ltd.] explanation is that our volume would go up because of the encouragement of the market is higher. People would come out here because we offer very high” rebates.

Still, from the commission’s point of the view, Guerrero said, the question was: would it increase the revenue?

Guerrero said the answer was yes.

“Before we approved it…we ran a couple of numbers. If you were to pay [a rebate] at 1.4 percent, 1.5 percent, all the way up to 2 percent, what would be tax implication at the end of the year?

“And our calculations are that we would come out better at the end of the year. So…it will be a better overall tax, both on a monthly basis versus the end of the year

This would happen even if the rebate was tax deductible, Guerrero said, “because the volume would increase,” or the number of players are expected to increase.

The commission approved on April 5 the casino’s rebate matrix for the casino rolling chip program.

Under the matrix, for example, if a player played between $20,000 and $500,000 the cash rebate offered to player would be 1 percent of the amount rolled. If a player rolled $500,000, the player would get one percent.

Under the matrix, if you play $5 million or more, the player gets 1.3 percent rebate.

The Saipan casino requested the commission to increase the “ceiling” from 1.4 to 1.8 percent rebate, which was approved.

What’s purpose of inviting businesses to the CNMI if you’re going to keep reducing their taxes? This thing does not make any economic sense. We wonder why the CNMI government cannot get out of its hole because they keep making the hole bigger.

I hope that when the Federal Government finally takes over the CNMI government, they conduct a full audit of all CNMI government agencies.

Increase the rebate amount and making it a tax deduction for Best Sunshine is going to generate revenue? Am my missing something? Well it certainly will for Best Sunshine not for the CNMI.

Are we operating on risky assumption like Mr. Guerrero have said or should we be operating based solid facts