Bill to increase tax on construction activities heads to governor’s desk

The House of Representatives has passed the Senate-amended version of House Bill 23-74 to essentially add a 3% tax on construction activities. The bill has since been forwarded to the Office of the Governor.

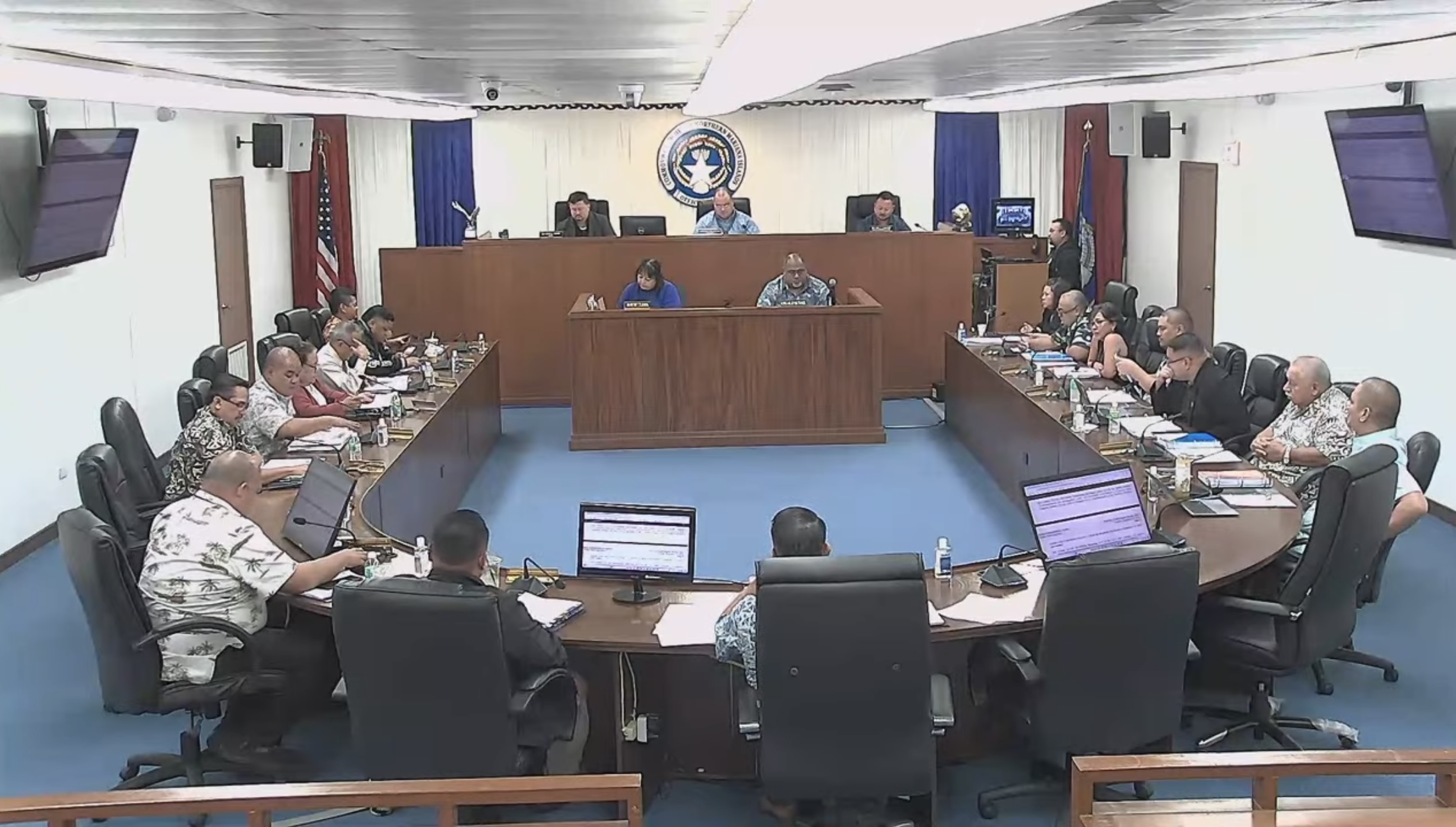

Last Tuesday, following nearly an hour-long regular session, the House of Representatives passed H.B. 23-74 House Draft 1, Senate Substitute 1; a bill that was introduced by Rep. Ralph N. Yumul (Ind-Saipan) over a year ago to impose an additional 3% tax to the yearly gross revenue that is directly derived from construction activities for a period of three years.

Authored by Yumul last year, H.B. 23-74 originally proposed to impose a 3% tax on construction activities with an expenditure threshold of $250,000.

The Senate Fiscal Affairs Committee increased this threshold to $350,000.

H. B. 23-74, HD1, SS1 passed the House yesterday by a majority vote of 18-1 with Rep. Thomas John Manglona (R-Saipan) the only one in opposition of the bill’s passage.

With the majority of the House in favor of passing the legislation, the bill now sits with Gov. Arnold I. Palacios for final approval.

“It’s just not the right time…[to] impose taxes on the private sector” was the sentiment shared by Senate President Edith DeLeon Guerrero (D-Saipan) during a Senate session last week where House Bill 23-74, which would impose a 3% tax on construction activities, was passed.

During a Senate session last week, H. B. 23-74, HD1, SS1 passed with a majority vote of 7-2; the opposing two being Senate President Edith DeLeon Guerrero (D-Saipan) and Sen. Dennis Mendiola (R-Rota).

Before voting on the bill, DeLeon Guerrero expressed that she believes it is not the right time to impose additional taxes on construction activities.

“It is not the right time to impose tax increases when we know that there are revenue activities being realized in at least one municipality here, Tinian, due to the military buildup. Tax increases will ultimately impact ordinary consumers, the people who are already suffering and can barely afford their family’s bare necessities,” she said.

DeLeon Guerrero further stated that raising taxes on a depressed economy, especially when businesses have yet to return to pre-pandemic levels, should not be the solution to the government’s lack of financial management and economic initiatives to generate fresh revenue to fund its programs.

“It’s just not the right time…[to] impose taxes on the private sector, which is the one producing revenues for the Commonwealth,” she said.

Lastly, DeLeon Guerrero said hopefully, from all of the revenues that will be generated from construction activities on Tinian, a supplemental budget can be submitted to the Legislature allowing them to address financial shortfalls.

The House of Representatives held a House regular session last Sept. 24.

-KIMBERLY B. ESMORES