Ogo bill tightens tax collection for B&Bs

Rep. Julie A. Ogo (Ind-Rota) has introduced a bill that clarifies and codifies the meaning of the terms “short-term accommodations” and “transient accommodation” to ensure the proper collection of taxes from bed-and-breakfast facilities in the CNMI. She touts this as a revenue-generating measure that avoids raising taxes further.

Ogo says her bill, House Bill 23-93, is needed to facilitate efficient enforcement of the laws and regulations by providing the mechanisms and tools for the government agencies to audit and inspect facilities and their operations.

“The Department of Finance and the Zoning Board need to make sure that properties for B&B operations are not disguised as house or residential rentals,” Ogo said.

The bill defines “short-term accommodations” as any hotel, motel, house, and apartel (apartment hotel) facility or owners of hotels, motels, apartels, houses—the whole house or a room in a house—, condominium and apartment units, or property that offers temporary accommodations or lodgings for a set fee and the length of stay of a guest(s) does not exceed 360 days.

It also defines “transient accommodation” as a short-term accommodation, lodging, or living accommodation of any kind, “for a set daily, nightly, weekly, or monthly fee multiplied by the length of stay, not exceeding 360 days, that a guest(s) rents in the Commonwealth.

The proposed bill also provides that all online and local platforms where “transient accommodations” are advertised, provide booking, and payment collection services are required to register with the Department of Finance to be certified for a fee through their local clients before engaging in an agreement to host bookings, payment service, and advertisements.

These hosting platforms will be required to file separate supporting records indicating their names, registration certificate numbers, names and addresses of local operators and booking data at the end of each Business Gross Tax Return cycle to be filed as a supporting document to the Hotel Occupancy Tax filing.

This will assist the Department of Finance in their auditing effort by giving them an edge to cross check and verify reported income of local operators on Business Gross Revenue filing, she added.

“We have been receiving inconsistent revenue reporting from the Department of Finance on B&B operations and many of the B&B clients have also been reporting that they were never charged Hotel Occupancy Tax. Therefore we need to do everything we can to give our regulatory agencies the legal foundation to promulgate efficient rules and regulations to verify reporting accuracy and collect due tax revenue, especially now that we are facing financial challenges.

“This measure should be understood by our agencies and general public as part of an effort not to resort to imposing more taxes. We all must work together by being each others’ eyes and ears so the government can continue providing public services.” Ogo, said.

Ogo’s bill is titled “To amend Title 4, Division 1, by adding a new Chapter 13 and repealing Chapter 5, § 1502, Hotel Occupancy Tax, and for other purposes.”

If anyone wants a copy of the bill and comment on it, contact Ogo’s office at 670-664-8888 or write to kuentosmarianas@gmail.com. (Saipan Tribune)

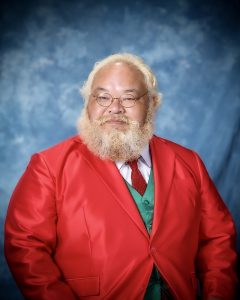

Rep. Julie Ogo