House committee OKs tax rebate cut

The House Ways and Means Committee recommended passage of a seven-month-old revenue-generating bill that cuts income tax rebate from 90 percent to 70 percent at the highest level of rebate with proportional reduction at the lower levels.

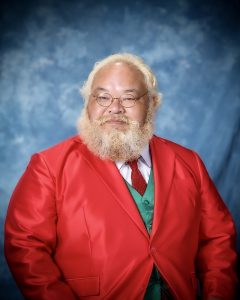

The panel recommends passage of House Speaker Joseph Deleon Guerrero’s (Ind-Saipan) House Bill 18-69 in the form of House Draft 1.

The bill cuts the rebate from the Northern Marianas Territorial Income Tax and appropriates the revenues from Chapter 7 tax to the NMI Retirement Fund’s defined benefit plan members.

In its report, the committee said reducing the 90 percent rebate will provide the CNMI with instant revenue for two fiscal years.

The Ways and Means Committee said funds collected under this proposal will directly assist in the payment of the 25 percent deferred retiree pension under the Retirement Fund settlement agreement.

Under the bill, the reduction in the rebate will take effect on Jan. 1, 2014, and be in effect for two years.

If the bill does not become law prior to Jan. 1, 2014, the Act will take effect on Jan. 1, 2015.

The bill has come too late for the proposed Jan. 1, 2014, effective date given that the last House session for 2013 was held last week.

The Saipan Chamber of Commerce, the largest business organization in the CNMI, said it is “adamantly opposed” to the tax rebate cut bill.

It said the term tax rebate “reductions” will increase income tax rates and withholding tax rates for companies and individuals in the CNMI.