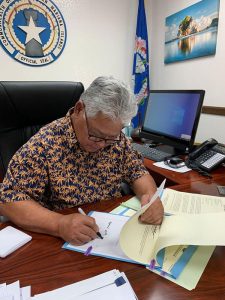

Palacios signs EITC bill into law

Acting governor Arnold I. Palacios signs into law Monday a bill that would repeal an existing CNMI law in order to make low-and moderate-income working families eligible for the Earned Income Tax Credit as a form of financial relief. (CONTRIBUTED PHOTO)

In his capacity as acting governor, Lt. Gov. Arnold I. Palacios signed into law Monday a bill that would repeal an existing CNMI law in order to make low-and moderate-income working families in the CNMI eligible for the Earned Income Tax Credit as a form of financial relief.

“This legislation is evidence that when we all work together, good things can happen,” said Palacios in signing House Bill 22-19, House Draft 1, into Public Law 22-03.

EITC is a refundable tax credit in the U.S. Internal Revenue Service Code that helps qualified low-to moderate-income working families and taxpayers get a tax break by allowing them to use the credit to reduce the taxes they owe, and in some cases, increase their tax refunds.

Describing it as a monumental bill, Palacios thanked the legislation’s author, Rep. Christina E. Sablan (D-Saipan), for her hard work in overseeing its passage.

He also commended Delegate Gregorio Kilili C. Sablan (Ind-MP) for ensuring that the Commonwealth and other U.S. territories are able to avail of full and permanent federal funding through the American Rescue Plan Act.

Palacios said that during the 902 Consultations with the Obama administration in 2017, Gov. Ralph DLG. Torres and members of his administration conveyed how significant implementing the EITC would be to the people of the Commonwealth.

Palacios also extended appreciation to Rep. Angel A. Demapan (R-Saipan) and Finance Secretary David DLG Atalig for the roles they played in the critical amendment of this bill. He said the amendment allows for the CNMI government to provide much needed assistance to working families while maintaining it ability to responsibly assess its financial capacities moving forward.

Rep. Christina E. Sablan (D-Saipan) said Monday that, with the signing of the bill into law, qualified low- and moderate-income taxpayers will be able to claim the EITC when they file their taxes next year.

Rep. Christina E. Sablan said the estimated annual value of the EITC is $25 million.

She thanked Palacios for signing the bill into law, and Delegate Gregorio Kilili C. Sablan, his Democrat colleagues in the U.S. Congress, and President Joe Biden for fully and permanently covering the EITC in the Marianas and all the territories with federal funds through the American Rescue Plan Act.

Rep. Christina E. Sablan said the work is not done yet, however, as the new law includes a provision inserted at the insistence of the administration and the Republican lawmakers in the House that essentially allows for the EITC to only be paid out as long as federal funds will cover it.

“The provision is problematic because it still presents a conflict with the CNMI’s obligations under the Covenant to adopt and implement a mirror tax code,” she pointed out.

Rep. Christina E. Sablan said they have learned from the congressional office that had they done a full repeal of the 100% local tax on the EITC as originally proposed in H.B. 22-19, they would have been able to pay out the EITC in this calendar year using ARPA funds set aside for state and local government operations.

“So, unfortunately, we missed an important opportunity,” she said.

It was Demapan who introduced a floor amendment to include a subsection to ensure that only the EITC law is being considered and does not include other excess credits outside of the EITC.

Members of the House unanimously voted to pass the bill last March. The Senate also unanimously passed the legislation last May.